What are the special features for standard combination in HKATS?HKATS generates derived order from the price of the outstanding Standard Combination Order and the prevailing market price of each individual leg. In addition, user can enter 'Day', 'Fill-or-Kill (FoK)' and 'Fill-and-Kill (FaK)' order for standard combination series, while Block Trade is not allowed to be executed. As all the combination series expire and rebuilt on a daily basis, no 'Good Till Cancel (GTC)' order is allowed.

What is Standard Combination Order?Standard Combination Order is the simultaneous purchase and/or sale of two different series with the same underlying. Each standard combination series is pre-defined by HKEX as a combination strategy with two legs in HKATS. Traders in HSI Futures market have been using Standard Combination Order in HKATS for calendar spreads (i.e. buy and sell two futures contracts with different expiration date simultaneously) in order to roll their open positions from spot month to the next month since June 2000. The orders have been used actively in futures trading, especially approaching the end of each calendar month.

What is the price reporting mechanism for standard combination trade?Standard combination trades are reported in corresponding legs of the standard combination series. All standard combination trades are reported in HKATS through the Ticker, Company Trades and Clearing Trades windows. Standard combination versus standard combination trades will carry the deal flag, 'STC', while standard combination versus outright trades will be marked as ‘Cbo v. Outr’.

Is there any market maker for standard combination series?There is no market maker for standard combination series and existing market makers have no obligation in responding quote request on standard combination series. On the other hand, the quotation from individual legs will be indirectly reflected on the standard combination order due to generation of derived order(s).

What are the benefits of using the standard combination order?

The benefit of using standard combination order is that it can be placed as a limit order instead of a market order, making each order visible to all HKATS users. Also, the transaction cost is likely to be reduced in terms of the spreads between the limit price and the bid/ask prices.

| The benefit of using standard combination order is that it can be placed as a limit order instead of a market order, making each order visible to all HKATS users. Also, the transaction cost is likely to be reduced in terms of the spreads between the limit price and the bid/ask prices. |

| The benefit of using standard combination order is that it can be placed as a limit order instead of a market order, making each order visible to all HKATS users. Also, the transaction cost is likely to be reduced in terms of the spreads between the limit price and the bid/ask prices. |

When would the Exchange notify broker on the cancellation of invalid Block Trade?Within 30 minutes of the execution of the Block Trade, the Exchange endeavour to notify the Exchange Participants if any criteria (such as permissible price range, minimum volume threshold) have not been met or any special margin is required. If all criteria have been met and the special margin could be settled within the prescribed time, the Block Trade would be novated and guaranteed by the Clearing House without further notice.

What are the differences between the Price Limit Up/Down Mechanism and Trading Halt Mechanism?The Price Limit Up/Down Mechanism applies to Futures Trading in T+1 Session. It would be triggered when the traded price reaches upper/lower price limit or the highest bid (lowest ask) of the buying (selling) queue reaches upper (lower) price limit, etc. When the Price Limit Up/Down Mechanism is reached, a market message would be broadcasted in HKATS. Trades within the price limit would be matched continuously.

THM applies to Options Trading in T+1 Session only. THM would be triggered only when the highest bid in the buying queue reaches the upper price limit or the lowest ask in the selling queue reaches the lower price limit. Once the Trading Halt Mechanism for an equity index option is triggered, trading of the concerned THM Exchange Contract would be suspended immediately for the remaining T+1 Session.

What are the purposes for introducing AHT?

The introduction of AHT would provide trading/hedging opportunities to investors in case there is a big event happening in the European or US market and that the client base and after-hours business would be increased. AHT could reduce the volatility in the next day’s opening as some investors would have hedged or adjusted their positions in the T+1 Session in response to news and events in the European or US time zones.

What will happen to the orders during Trading Halt? The orders of the halted THM Exchange Contract will remain in the order book but will not be matched. EPs may amend or cancel any of their existing orders. The amendment of order during the trading halt is confined to the following:

1. Modify information in Cust and/or Info Fields

2. Change duration of validity

3. Decrease quantity

What are the products available for trading in AHT?MSCI Taiwan (USD) Futures, MSCI Taiwan 25/50 (USD) Futures, Hang Seng Index Futures, Hang Seng China Enterprises Index Futures, Mini-Hang Seng Index Futures, Mini-Hang Seng China Enterprises Index Futures, Hang Seng Index Options, Hang Seng China Enterprises Index Options, Hang Seng Index Futures Options, Hang Seng China Enterprises Index Futures Options, Mini- Hang Seng Index Options ,Mini-Hang Seng China Enterprises Index Options , Weekly Hang Seng Index Options, Weekly Hang Seng China Enterprises Index Options, Hang Seng Index Total Return Index Futures, Hang Seng China Enterprises Index Total Return Index Futures, Hang Seng TECH Index Futures Hang Seng TECH Index Option, Hang Seng TECH Index Futures Options, CNH London Metal Mini Futures, USD London Metal Mini Futures, CNH Gold Futures, USD Gold Futures, CNH Silver Futures, USD Silver Futures, Iron Ore Futures, MSCI Vietnam (USD) Index Futures, MSCI Philippines (USD) Index Futures, MSCI China (USD) Index Futures, MSCI China A 50 Connect (USD) Index Futures, Currency Futures & MSCI Late Close Contracts #are available for trading in AHT.

# https://www.hkex.com.hk/-/media/HKEX-Market/Services/Circulars-and-Notices/Participant-and-Members-Circulars/HKFE/2022/MO_DT_282_22_e.pdf

What would be the trading hours for AHT?

- 2:30 p.m. to 03:00 a.m. (next day) for MTW & TWP Futures

- 5:15 p.m. to 03:00 a.m. (next day) for HSI/HHI/MHI/MCH/HTI Futures and Options, Weekly Options, HSI/HHI/HTI Futures Options, London Metal Mini futures, Iron Ore Futures, Gold Futures, Silver Futures, Total Return Index Futures & MVI, MPS, CHI, MCA Futures

-

7:15 p.m. to 03:00 a.m. (next day) for Currency Futures & Options & MSCI Late Close Contracts.#

# https://www.hkex.com.hk/-/media/HKEX-Market/Services/Circulars-and-Notices/Participant-and-Members-Circulars/HKFE/2022/MO_DT_282_22_e.pdf

What would be the trading arrangement for Block Trade Facility (BTF) in AHT?

The trading arrangement of BTF in AHT is the same as that in the T Session, except that:

- block trade prices for futures will also be subject to the +/-5% price limit in T+1 Session; and

- Special Block Trade Margin (SBTM) will be applied as usual. However, as there is no banking support during T+1 Session, any block trade and/or related trade adjustment will be rejected if there is insufficient collateral in relevant participant’s CCMS Collateral Account to satisfy the SBTM.

Is TMC allowed in AHT?Tailor-Made Combination trades are available in AHT session for Hang Seng Index (HSI) futures and options, H-shares Index (HHI) futures and options, Mini HSI (MHI) futures and options, Mini H-shares Index (MCH) futures and options only.

Why would there be a price limit up/down mechanism for AHT? Would price limit mechanism be introduced in T Session as well?We believe a price limit will provide market stabilizing effect to calm market overreaction in the T+1 Session. Major derivatives exchanges also have similar price limit arrangements in their after-hours index futures trading.

The price limit up/down mechanism is as follows.

a) No sell order of price below 95% and no buy order of price above 105% of the last traded price of the spot month contract in the T Session are allowed in the T+1 Session.

b) Trading (for all contract months) will be allowed only within the price limit range during the T+1 Session.

c) The price limit of 5% (for index futures) and 7% (for currency futures) will be reviewed if necessary.

Trading in T Session would not be subject to this price limit up/down mechanism.

Is it compulsory for EPs to participate the AHT?

It is not compulsory for EPs to participate the AHT as different EPs may have different considerations such as their clients’ trading interest and operational / resources requirements. Whether to participate in AHT is a business decision for each EP to make on its own. We anticipate that for EPs which are currently offering European or U.S. derivatives trading for their clients, AHT will be an opportunity to expand their existing business with limited operational impact.

What should be done for EPs without night desk operations?For EPs currently without night desk operations, they may consider the needs of their clients and the potential business prospect and decide whether they will participate or only provide limited services to their clients in after-hours trading. In any event, EPs should ensure that they observe the SFC’s Code of Conduct when dealing with clients on all matters in relation to the AHT.

What is the impact to those EPs that decide not to participate?

Those EPs should assess the business opportunities in AHT and their services to be provided to their clients during the AHT. If they decide not to participate in AHT, they need to ensure that their clients are aware that they would not accept clients’ orders during and for the T+1 Session. Theymay face pressure from their clients who would like to participate in T+1 Session and they may run a risk in losing these clients too.

What is the clearing arrangement for AHT?

Trades executed in the T+1 Session will be registered as the following Business Day’s trades, together with trades executed in the following Business Day’s T Session. The DCASS services will start at 7:30 a.m. for respective AHT products until System Input Cutoff Time.

Positions are maintained according to clearing dates and separate records are held at all times for T day and T+1 day positions. T day positions will be finalized at System Input Cutoff Time and subject to day-end margin calculation. T+1 day positions will be finalized at T+1 Session Cutoff Time. These T+1 day positions will become T day’s opening positions on the following Business Day, i.e. the T day’s positions are made up of positions created during the T Session on that Business Day plus trades / post-trades executed during the T+1 Session of the previous Business Day.

For trades executed in the T+1 Session, Participants can perform post-trades (i) up to the T+1 Session Cutoff Time; and/or (ii) from 7:30 a.m. on the next Business Day till System Input Cutoff Time. If Participants want to incorporate those trades executed in the previous T+1 Session in the calculation of mandatory intra-day variation adjustment and margin, they should complete the post-trade activities 30 minutes before market open of the corresponding products.

Remarks: For any discrepancies between this FAQ and the HKCC Rules & Operational Procedures, the HKCC Rules & Operational Procedures shall prevail.

What would be the risk management arrangement for AHT?

In the absence of a level of banking support to facilitate intra-day call capability during the T+1 Session similar to that during the T Session, the following additional risk management measures will be implemented to mitigate the counterparty risks associated with AHT.

- Perform monitoring of CPs’ net capital-based position limit (CBPL) based on both the current market prices and positions at regular intervals during the T+1 Session, supplemented by ad-hoc CBPL monitoring. CPs breaching their CBPL will be requested to reduce their exposure to ensure their CBPL compliance. CPs may be disconnected from the HKEX trading system and subject to closing out action by HKEX should they fail to comply with such request or further increase their exposure.

- A mandatory variation adjustment (VA) and margin call to markets (based on the morning Calculated Opening Prices (COP) or market price shortly after the market open if COP is not available) with T+1 Session will be introduced following the market open of each T Session. Unlike the current ad-hoc intra-day call which includes VA only, this mandatory call will include both VA and margin of all positions as of thirty minutes before the relevant market open of the morning trading session. The call will be issued to CPs by 10:00 a.m. and the payment shall be settled by 12:00 noon. The Calculated Opening Price is the equilibrium market price derived from the price discovery period of thirty minutes before the opening of the morning trading session.

- There will be no intra-day variation adjustment or margin call during the T+1 Session.

Would there be any Risk Parameter Files (RPFs) during AHT session for CPs reference?Risk Parameter Files (RPF) are generated for AHT Capital Based Position Limit (CBPL) monitoring and will be made available for download hourly in AHT Session under normal circumstances. Please note that these RPFs are calculated based on latest market prices and are for CPs’ reference only. They may not be equivalent to the RPFs that require actual money settlement.

Is there any kind of order type allowed in AHT_PRE_MKT_session?This should be the same as the normal pre-market session, i.e., no new orders can be entered but instead change (not affecting order priority)/cancel T+1 orders are allowed. Since there is no pre-opening session (auction session) for AHT so no auction order is allowed.

What are the design principles behind the VCM model for Hong Kong?

HKEX’s proposed VCM is specifically designed to safeguard market integrity from extreme price volatility arising from automated trading (“Flash Crash”, bad algorithms, etc.). It also serves to alert the market with a temporary cooling-off period for the participants to reassess their strategies and positions and make investment decisions. It is not a trading halt, does not intend to limit the ups and downs of prices due to fundamental events, and it also does not work the same way as the daily price limit model which sets a specific daily price range for derivatives trading as seen in some markets.

Special care has been taken in VCM design to minimise market interruption. For example, it applies to individual instrument rather than the entire market, it is based on a dynamic rather than a static reference price, the triggering level of ±5% is set up such that it would not be triggered too often, VCM is not applicable in certain periods (the first 15 minutes of the morning and afternoon trading session and the last 20 minutes of the afternoon trading session) and to certain instruments.

How does the VCM model work?

HKEX has adopted a dynamic price limit VCM model, which would trigger a cooling-off period in case of abrupt price volatility is detected at the instrument level.

The following diagram illustrates the case of a VCM trigger on an applicable instrument.

/VCM-Eng.PNG)

- VCM is applicable for the normal trading session excluding the Pre-Market Opening Period and After-Hours Trading session.

- During the normal trading session, the potential trade price of a VCM Exchange Contract will be continuously checked against a dynamic price limit of ±5% based upon the reference price which is the last traded price 5 minutes ago.

- VCM is triggered if a futures contract is ±5% away from the last traded price 5-min ago; A 5-min cooling-off period will start.

- During the cooling-off period, trading is allowed within a pre-defined price band.

- Normal trading with VCM monitoring will resume after cooling-off period.

What instruments are covered under the VCM? VCM covers spot month and next calendar month contracts of the Hang Seng Index (HSI), Mini-Hang Seng Index (MHI), H-shares Index (HHI), Mini H-shares Index (MCH) and Hang Seng TECH Index (HTI) futures markets.

What is the applicable period for VCM monitoring?

VCM monitoring is applicable to continuous trading session (CTS), excluding:

- the first 15 minutes of the morning and afternoon trading session

- the last 20 minutes[1] of the afternoon trading session

*[1] Since a cooling-off period will last for 5 minutes, the monitoring will stop 20 minutes before end of the Afternoon Session

Does HKCC CPs require to settle any HKCC Participant Additional Deposits (HPAD) during H Days? The settlement of HPAD, which is the CPs’ contribution to the Reserve Fund (RF), will not be required on H Days.

After the implementation of holiday trading, should the monthly review fall, or an ad-hoc review be triggered, on an H Day, HKCC will recalculate the RF based on the latest positions and informs all CPs of their recalculated HPAD on the first Trading Day (which is also the Business Day) after H Day(s).

What is the price snapshot for MMC calculation on H Day?Same arrangement as Business Day will be applied on H Day.

For the avoidance of doubt, as there is no trading for NH Products on H Day, the price snapshot of MMC for NH Products will be the daily settlement price on H-1 day.

Will Clearing House increase margin prior to or during a long holiday?Currently, HKCC will increase the margin levels temporarily (i.e. holiday margin) for some major products before public holidays. Same arrangement will continue to apply to the following products after the implementation of holiday trading:

(i) NH products (e.g. HSI and HSCEI products)

(ii) H products which has margin offset with NH products

For other H products which do not have margin offset with any NH products, normal margin will be applied. Nevertheless, HKCC has the discretion to apply holiday margins or increase margins on products which may pose liquidity concerns on H days.

With the implementation of Holiday Trading, we will continue to conduct adhoc margin review for H products on H Days (i.e. the effective day of increased margin rates can fall on H Day).

Nevertheless, for the scheduled monthly margin review, the effective day of new margin rates for all products including H products will remain as the next HK Business Day (i.e. not fall on H Day).

H CP is required to settle all margin obligations with the prevailing margin rates (including the adhoc increase in margin) on H Day.

Can CP fulfill CNH margins by USD fully?The current collateral policy for RMB margin requirement will remain the same on Holiday Trading Days, i.e. there is a fixed limit of RMB 1 billion for the RMB margin requirement. Where the Clearing Participant’s (CP’s) margin requirement is on or below the limit, the CP is allowed to fulfill all the RMB margin requirement by any acceptable collateral (such as USD cash) where non-cash collateral could satisfy up to 50% of the margin requirement. Beyond limit, the CP’s margin requirement shall be satisfied by RMB cash. Please refer to the Consultation Paper Appendix 5 paras 14 and 16 (p.27) for reference.

Does CP need to fulfill margin requirement for NH products on H Days?H CPs are required to settle all payment obligations (including obligations for HKD and other currencies) arising on H Days. NH CPs are not be required to fulfill any HKCC payment obligations during H Days, and outstanding payment obligation will be settled the next Business Day after an H Day (H+1 Day).

During HK and US mutual holiday, can clients settle margin call later than the next Trading Day?For the purpose of EP’s assessment under HKFE Rule 617(b) for the criteria of Established client, it is considered acceptable not to treat the outstanding margin call of the client as an unfulfilled margin call as long as the EP could obtain the documentary evidence that (i) there is sufficient funding with the bank to fulfil the margin obligations, (ii) fund transfer instructions have been placed with the bank pending completion due to the abovementioned reason and (iii) the fund transfer in (ii) being completed on the day which H Products open for trading immediately after US banking holidays.

Is HKEX supporting excess withdrawal on H day?HKEX is able to support the withdrawal process (we have such process in place today). However, on holiday, HKEX is capable to process the withdrawal, but the settlement banks are not able to support this on day 1 (due to number of concerns in its banking infrastructure/system and etc). This is under our radar and we are actively working with them.

Is it allowed to settle margin requirements of MSCI products in HKD on H Day?To alleviate the funding pressure on H Days, HKEX revises the 50-50 collateral rule for HKD and USD denominated contracts on H Days. H CPs are allowed to fulfill all their HKD and USD margin requirements by any acceptable collaterals (where non-cash collateral could satisfy up to 50% of the margin requirements) on H Days.

Would HKCC perform default management during H Days?The default management process during an H Days will be similar to the procedures on a Business Day. H Products which are not subject to holiday margin, HKCC will perform default management on HK public holidays. For H Products which are subject to holiday margin, the market risk exposure throughout the H Days will be mitigated by the margin collected beforehand, so there will be sufficient resources for HKCC to perform liquidation after H Days. HKCC retains the flexibility to perform liquidation on H Days.

What is HKATS? Hong Kong Futures Automated Trading System (HKATS) is the electronic trading system for the HKEX derivatives market. Trading is conducted via workstations or Open Application Programming Interfaces (OAPI) located at the premises of Futures Exchange Participants and Stock Options Exchange Participants.

HKATS provides real-time data such as traded price and quantity, day high/low, turnover, price depth and order depth. Users can view real-time price information on a computer screen, click on a bid or ask price and execute an order.

With HKATS, Exchange Participants can provide their clients with full electronic order routing, straight-through trade processing and other value-added services, and also supply detailed information such as the exact time of order placement and execution.

The Hong Kong Futures Exchange began introducing electronic trading in November 1995, when open outcry trading was still the main trading method among international derivatives exchanges. The electronic trading system was subsequently upgraded and was renamed HKATS in April 1999. Since then, there have been a number of upgrades of the HKATS hardware and software.

For more information about HKATS, please refer to "Derivatives Trading Infrastructure" under the "Market Operations" section of the HKEX website.

Does HKEX have contingency/recovery plans if its securities or derivatives trading system fails?In the event of trading system or equipment failure, contingency measures are in place to resume trading as soon as possible.

In case of service interruptions caused by fire or major hardware failure at the OTP-C or HKATS primary site, trading will switch to the OTP-C or HKATS backup system at the backup site. Site failover will normally take 45 minutes to 1.5 hours, and reasonable time will be allowed to inform the market before trading resumes.

Will HKEX compensate those who suffer losses due to market system failure?HKEX has exercised Due Diligence to ensure the normal functioning and operation of its market systems. HKEX has also developed a set of contingency arrangements to cope with system emergencies. According to the Securities and Futures Ordinance, HKEX will not incur liability in respect of anything done or omitted to be done in good faith.

What kinds of investors are suitable for trading in futures and options? Futures and options are not for all investors given their higher inherent risks than many other products. Investors should consider their tolerance for market volatility and losses, and consult their brokers or qualified financial advisers to see whether futures and options fit their personal needs.

What are the risks to be considered before trading in futures and options?There are a number of risks inherent in futures and options trading. Some major ones are summarised below, but the information is by no means exhaustive. Investors should make sure they understand the nature of a contract and the inherent risks before trading.

i. Futures

The “leverage” effect brings substantial risk

The amount of initial margin is small relative to the value of the futures contract so that transactions are 'leveraged'. This may work against investors as well as for investors as a relatively small market movement will have a proportionately large impact on the funds invested or to be invested. Investors may therefore sustain a total loss of initial margin funds and any additional funds deposited with brokers to maintain their positions. If the market moves against their positions or margin levels are increased, investors may be called upon to pay substantial additional funds on short notice to maintain their position. If they fail to comply with a request for additional funds within the time prescribed, their positions may be liquidated at a loss and they will be liable for any resulting deficit.

Risk-reducing strategies may not be effective

The placing of limit orders or stop-loss orders may not be effective because market conditions may make it impossible to execute such orders. Strategies using combinations of positions, such as 'spread' positions may be as risky as taking simple 'long' or 'short' positions.

ii. Options

Variable degrees of risks

Purchasers and sellers of options should familiarise themselves with the type of options (i.e. put or call) which they contemplate trading and the associated risks. Investors should calculate the extent to which the value of the options must increase for their position to become profitable, taking into account the premium and all transaction costs.

The purchaser of options may offset or exercise the options or allow the options to expire. The exercise of an option results either in a cash settlement or in the purchaser acquiring or delivering the underlying interest. If the purchased options expire worthless, investors will suffer a total loss of their investment which will consist of the options premium plus transaction costs. If investors are contemplating purchasing deep-out-of-the-money options, they should be aware that the chance of such options becoming profitable ordinarily is remote.

Selling options generally entails considerably greater risk than purchasing options. Although the premium received by the seller is fixed, the seller may sustain a loss well in excess of that amount. The seller will be liable for additional margin to maintain the position if the market moves unfavourably against him. The seller will also be exposed to the risk of the purchaser exercising the options and the seller being obligated to either settle the options in cash or to acquire or deliver the underlying interest. If the options are 'covered' by the seller holding a corresponding position in the underlying interest or a futures or other options contracts, the risk may be reduced. If the options are not covered, the risk of loss can be unlimited.

iii. Others

Terms and conditions of contracts

Investors should ask their brokers about the terms and conditions of the specific futures or options contracts and associated obligations (e.g. the circumstances under which investors may become obliged to make or take delivery of the underlying asset of a futures contract and, in respect of options, expiration dates and restrictions on the time for exercise). Under certain circumstances (e.g. the issue of bonus shares by a listed company or payment of large special dividends), the specifications of outstanding contracts (including the exercise price of options) may be modified by HKEX to reflect changes in the underlying asset.

Suspension or restriction of trading

Market conditions (e.g. illiquidity) and/or the operation of the rules of certain markets may increase the risk of loss by making it difficult or impossible to effect transactions or liquidate/offset positions. If investors have sold options, this may increase the risk of loss.

What are the trading hours of the HKEX derivatives market?

The trading hours (including the last trading date, the expiry date and the final settlement date) of different derivatives may vary. For details, investors may refer to the trading calendar and the contract summary of each product in “Listed Derivatives” under the “ Our Products” section of the HKEX website.

What is the function of the pre-market opening session in Hong Kong’s derivatives market?

The pre-market opening session (POS) helps establish an orderly market open when the trading system is loaded with large numbers of orders and provides the market with a fair mechanism to determine the calculated opening prices (COP) at which the largest possible number of contracts may be traded, based on a predetermined formula. This helps to maintain order at the market open and minimise price fluctuation. During the pre-market opening session, the COP is established before the market open without matching orders.

At present, the pre-market opening is only available for the trading of HSI, MHI, HHI and MCH futures contracts, MSCI Taiwan Index related futures contracts and Hang Seng TECH Index futures contracts.

A random cutoff mechanism is applied to the pre-opening session and the pre-open allocation session. This enhancement aims to deter the possible gaming strategy of manipulating the COP near the end of the auction process and also to encourage order input at an earlier stage. It will be applied to the POS for both morning and afternoon sessions of the applicable markets.

What is Calculated Opening Price (COP)?

During the pre-market opening session, a COP will be calculated if the highest bid price of the limit orders entered into electronic trading system is greater than or equal to the lowest ask price of the limit orders, and the price will serve as the market opening price for the corresponding product. If more than one price satisfies this criterion, the COP will be calculated according to the established formula set forth in Rule 4.83 of the trading procedures for stock index futures and options under the Rules, Regulations and Procedures of the Futures Exchange. The rules are available in the “

Rules and Regulations” section of the HKEX website.

What are the charges involved in futures and options trading?

Futures and options brokerage is negotiable between brokers and their clients. All futures and options traded on HKEX's derivatives market are stamp duty free. Other charges including the Exchange Trading Fee and the SFC(Securities and Futures Commission) Levy vary from one product to another. Investors should consult their brokers and read carefully the contract specifications before trading. Details of trading fees are available in the “

Derivatives Products” under the “

Products & Services” section of the HKEX website.

Why is it necessary to pay margin for trading futures and selling options contracts?

The clearing houses of HKEX acts as the central counterparty to both the buyer and seller of futures and options so that the counterparty risk of both parties is limited to a single counterparty.

As the central counterparty, it is the clearing house’s statutory duty to manage the risks associated with the clearing and settlement business in order to maintain a stable and orderly clearing and settlement system for the different exchange traded financial products. To this end, HKEX use a series of risk control measures, and one of them is the margin requirement.

Clearing House Participants (i.e. brokers) are required to pay to the clearing house a Clearing House Margin in respect of their open interest (held by the Participants themselves or for their clients). Clearing House Participants in turn charge their clients an amount not less than the Client Margin. There are two types of Client Margin: Initial Margin and Maintenance Margin. The amount of margin is determined by the clearing house using a programme named Portfolio Risk Margining System of HKEX (PRiME) taking into account the historical price volatility of the underlying products (e.g. stocks, indices etc), market conditions and other relevant factors. When opening a position, an investor is required to pay an initial margin to a Clearing House Participant, which then calculates the floating profits or losses of the investor’s position each day after the market close and credits or debits the margin balance accordingly. If the initial margin deposit falls below the maintenance margin, a margin call will be issued, and the investor must deposit additional funds to restore the account to the initial margin level if he does not want to close the position.

How do investors know the futures or options margin requirements?

The margin charged by brokers may vary depending on their assessment of the financial conditions and position of a particular client, but will not be less than the minimum amount stipulated by HKEX. HKEX prepares on a daily basis a margin reference table using historical figures. Brokers may refer to the table when assessing the client margin every trading day. The margin reference table is posted at “

Derivatives Products” under the “

Products & Services” section of the HKEX website. It should be noted that the margin reference table only sets out the minimum margin. The exact margin charged by brokers depends on the financial conditions of each particular client.

What is Close Out?

Futures – An investor can close out his position by buying or selling futures contracts of the same expiry date and quantity but in the opposite direction in order to offset his original position. After the position is closed out, he will no longer have any position in the same futures contracts in his account.

Options – Where an investor makes an opposite order after buying options contracts, i.e. selling the same quantity of options contracts, his position in the options contracts will be closed out.

What is Open Interest?

Open Interest is the total number of futures or options contracts that have been bought or sold, but not settled by offsetting transactions or fulfilled by delivery of the underlying asset. Each open transaction has a buyer and a seller, but for the calculation of open interest, only one side of the contract is counted by the clearing house.

What is Roll-over?

Roll-over involves closing out the expiring position in futures/options contracts first and opening a new position with a later expiry date but the same contract specifications. For example, an investor who has opened a short position in Hang Seng Index futures contracts which expire in September but remains bearish on the performance of the Hang Seng index in October may close out the September contracts and open a short position in Hang Seng index futures for October expiry. The move to renew a futures contract is called roll-over.

What are the orders commonly used in futures and options trading?

Orders that are more commonly used are set out below. Investors should contact their brokers to see if they provide the relevant services before placing an order.

Auction Order - An Auction Order is an order where a bid or offer price is not specified and is entered during the pre-market opening session for execution at the Calculated Opening Price (COP). Given the difference in the quantity of buy orders and sell orders during the auction session, not all auction orders may be matched. Unmatched auction orders will be converted to limit orders at COP, or the best bid or the best ask after the market opens. Where investors predict the market will go up or down at market open, they may input auction orders to buy or sell their contracts at the opening price before the market opens.

Limit Order - A limit order is an order to buy or sell at a specific price or a better price. Investors who do not feel there is an urgent need to execute a trade or who are determined to try to capture the short-term trend in price may input limit orders to try to buy or sell contracts at the price they have in mind.

Market Order - A market order is an order to buy or sell immediately at the current available price without any price restriction. For investors who feel there is an urgent need to buy or sell contracts, the quickest way to execute a trade is to input a market order. However, investors should note that the execution price may deviate from the price they have in mind.

Stop Order - A stop order is an order to buy or sell at a specified price. Where the current market price is the same as the specified price, the stop order will be converted into a market order immediately. During futures trading, a stop order is often used to close out investors’ positions to minimise losses and manage risks. Therefore, a stop order is also known as the stop-loss order.

To increase order flexibility, additional instructions may accompany an order input. Some commonly used instructions are set out below.

Rest of Day - Orders are valid only on the trading day indicated by investors, and become invalid after the market close.

Fill or Kill - Applicable to a limit order only. Where the order cannot be matched at the exact quantity of contracts at the specified price, it will be cancelled automatically at once and will not be executed. For example, an order to buy 10 contracts will be cancelled if there are only five contracts available in the market at the moment.

Fill and Kill - Applicable to a limit order only. Its purpose is to execute as many contracts specified in the order as possible and cancel the remaining unmatched portion. For example, if an investor intends to buy 10 contracts but there are only six available in the market, six contracts will be bought, the remaining four will not be bought and the unfilled part of the order will be cancelled.

Will investors be given any acknowledgement after trading in futures and options?

Like trading in securities, brokers issue a contract note to their clients upon the closing of a transaction or their clients will receive a daily activity statement after the market closes on the day the transaction is completed. All relevant information of the transaction and the balance of the account at the cut-off date are covered therein. In addition, a statement of account is issued by brokers on a monthly basis. Investors should check carefully the information on these statements.

What are the key changes in relation to the renewed SDNet/2 service contracts between HKEX and Accredited Vendors’? HKEX has renewed the SDNet/2 service contracts with the three existing Accredited Vendors effective from 1 March 2016 and below are the key changes :

- Capped prices will only be available for 1Mbps to 20Mbps circuits and there will be NO capped price for circuits with bandwidth of 30Mbps or above. The new pricing arrangement is applicable to monthly tariff, installation charge and standby service fee.

- There is also change to certain one-off charge e.g. circuit bandwidth upgrade/downgrade, reconfiguration and relocation fee of specific Accredited Vendors.

- Introduction of Application Service Provider (ASP) circuit connection to SDNet/2

What is the installation cost of SDNet/2 circuits?EPs/CPs/CMs/ IVs are advised to contact the Accredited Vendors directly for the prices of SDNet/2 circuit and related services.

Currently, there are some situations where the Accredited Vendors are not allowed to install fibre cables (e.g. inside premises of data centre service providers or buildings whose building & management offices who sell their own fibre cables). EPs/CPs/CMs/IVs may need to bear the extra services cost charged by third parties. In such cases, EPs/CPs/CMs/IVs are advised to check with the Accredited Vendors because the degrees of installed fibre at each building by different Accredited Vendors may vary.

Due to the fact that the installation environment varies in different sites, the selected Accredited Vendor will carry out site visit to the offices of EPs/CPs/CMs/IVs and will discuss with the EPs/CPs/CMs/IVs on the facilities required for the circuit installation. Therefore, EPs/CPs/CMs/IVs should check with the Accredited Vendors if there is any extra cost required for the circuit installation according to actual situation.

After installation of the SDNet/2 circuits, can EPs/CPs/CMs/IVs terminate the service contract any time and change to another Accredited Vendor?The minimum subscription period of SDNet/2 circuit is 3 months.

If EPs/CPs/CMs/IVs wish to terminate the service within the minimum subscription period, they can submit 1 month’s advance notice to the respective Accredited Vendor to terminate the service at the end of the 2nd month.

After the 3-months minimum subscription period, EPs/CPs/CMs/IVs can terminate the service by giving 1 month’s advance termination notice to the respective Accredited Vendor.

Accredited Vendor has the right to ask for any remaining or outstanding payment due to the service termination. EPs/CPs/CMs/IVs should check with Accredited Vendor beforehand whether it is applicable for its service terms and conditions.

How should EPs/CPs/CMs/IV/s select their Accredited Vendors?All Accredited Vendors must provide SDNet/2 service according to the pre-defined technical requirements from HKEX. Technically, SDNet/2 circuits provided by all Accredited Vendors are fully compatible with the market systems of HKEX.

EPs/CPs/CMs/IVs are advised to contact their selected Accredited Vendors and consider the commercial offers and services provided by individual Accredited Vendor. EPs/CPs/CMs/IVs are advised to select Accredited Vendors according to their own business needs. Before selection, EPs/CPs/CMs/IVs are advised to study carefully the terms and conditions offered by the individual Accredited Vendor

If EPs/CPs/CMs/IVs want to downgrade the SDNet circuit bandwidth, would it affect the existing connections?EPs/CPs/CMs/IVs should subscribe not lower than the specified minimum bandwidth. The minimum bandwidth requirements of the respective market systems can be found in the [Price Information /Technical Specification/Service level of SDNet/2 or OMD Connectivity Guide]

http://www.hkex.com.hk/eng/market/sec_tradinfra/sdnet2.htm or

http://www.hkex.com.hk/eng/market/dv_tradinfra/sdnet2.htm or

http://www.hkex.com.hk/eng/market/clr/secclr/sdnet2.htm or

http://www.hkex.com.hk/eng/prod/dataprod/omd/implementation/Phase1a.htm or

http://www.hkex.com.hk/eng/prod/dataprod/omd/Phase2.htm

EPs/CPs/CMs/IVs may subscribe more than the minimum bandwidth from the Accredited Vendors in accordance with their business needs.

What is ASP connection?ASP (”Application Service Provider”) is the service provider providing shared SDNet/2 circuit services connectivity to multiple EPs/CPs/CMs/IVs. Under the ASP connection service, ASP will subscribe the SDNet/2 circuits from the Accredited Vendor(s) and manage the network connectivity on behalf of the EPs/CPs/CMs/IVs.

ASPs should contact the Accredited Vendor regarding the application of ASP connections and HKEX-IS on the data licensing requirement.

EPs/CPs/CMs/IVs should contact their respective software/system providers regarding the ASP connection services.

Who are eligible to apply for ASP connection?The ASP connection initiative aims to enhance the infrastructure efficiency of the application providers who are also providing managed services to market participants. Therefore, BSS vendors / OAPI developers / Market Data ASPs are eligible to apply for the ASP connections. However, HKEX reserves the right of final decision.

What application accesses can be aggregated on an ASP connection?Currently, the HKEX Application accesses allowed to be aggregated on ASP connection are listed as follow:

Cash Market and China Connect Market: OCG, OMD-C, CCCG, OMD-CC

Derivatives Market: HKATS connection through Central Gateway, DCASS connection through Central Gateway, OMD-D

Market segregation is required, which means that an ASP connection may only access to either Cash Market and China Connect Market applications or Derivatives Market applications.

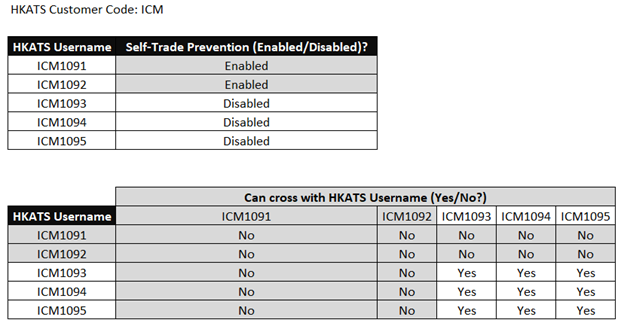

What is the existing SMP service in derivatives market?Currently, HKEX offers self-match prevention (“SMP”) service to derivatives market (details refer to the link) and it is an optional and free-of charge service. Should Exchange Participants (“EPs”) enable SMP for specific HKATS Username(s), orders from such HKATS Username(s) will not be matched with other orders within the same HKATS Customer Code.

An illustration as follows:

![]()

Aggressive orders instead of resting orders will be deleted by the system before the point of matching.

Currently, the existing SMP can only delete orders within same HKATS Customer Code, it cannot delete orders across HKATS Customer Code and/ or across Exchange Participants (“EPs”).

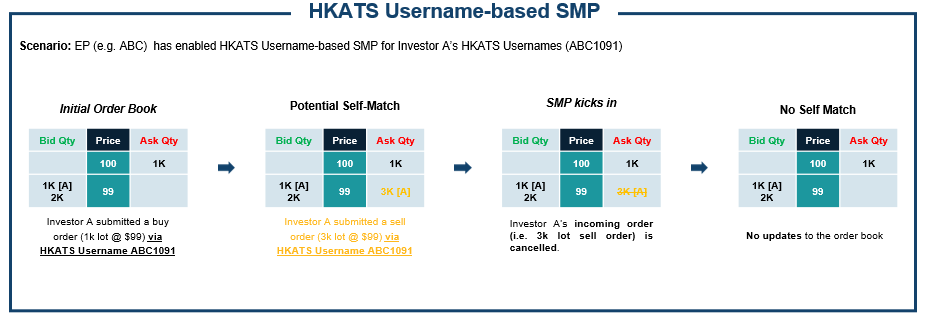

What are the SMP enhancements?The existing SMP model at HKEX, based on HKATS Username (“HKATS Username-based SMP”) (details in link), will remain in service and unchanged in feature (i.e. without the enhanced features) after the introduction of the new SMP model (“ID-based SMP”).

Meanwhile, ID-based SMP is targeted to be provided in derivatives market in Q2 2024 subject to market readiness and regulatory approval.

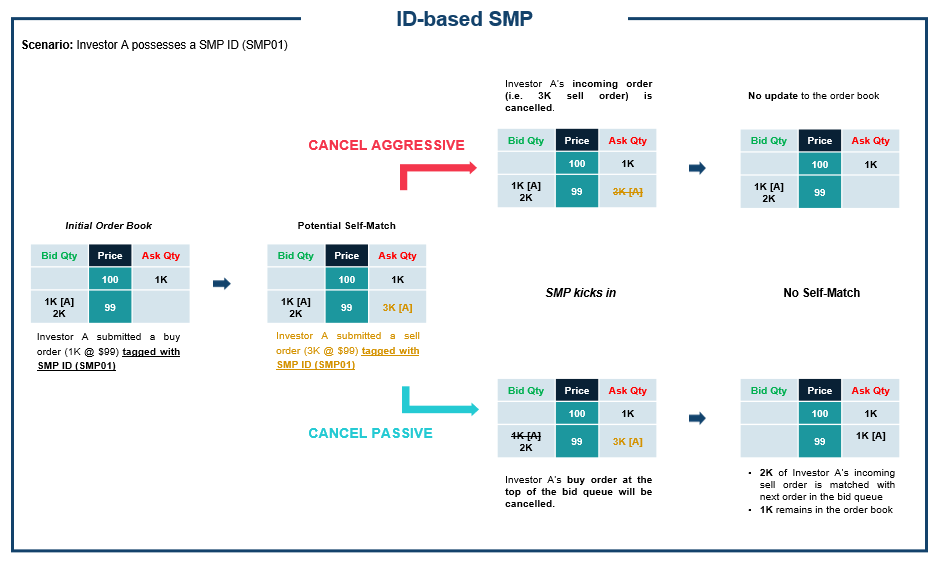

Key features of ID-based SMP includes:

- Introduction of SMP ID as identifier for triggering SMP: Under the new SMP model, SMP will be based on an identifier (“SMP ID”) assigned by the Exchange to cancel potential self-matched orders[1]. During continuous trading session, a buy order and a sell order with the same SMP ID will be prevented from executing against each other, and either one side of orders will be cancelled according to the pre-specified cancellation method of the respective SMP ID.

EPs and/or their clients who apply for the SMP model will be assigned a designated and unique SMP ID by the Exchange upon successful registration. SMP users can tag their assigned SMP IDs to their own orders to prevent self-matching. The Exchange will announce the details of SMP registration in due course.

- Cancel aggressive order (“CA”) and cancel passive order (“CP”) as order cancellation method: Each SMP ID must be specified with either one of the two order cancellation methods. Upon a potential match between two orders bearing the same SMP ID with a designated cancellation method:

a) the incoming order will be cancelled if CA is chosen; or

b) the resting orders will be cancelled if CP is chosen.

- Multi-broker model: This new SMP model would prevent self-matching of orders tagged with the same SMP ID via different EPs.

*[1] including all order types (with the exception of combo/bait order against outright) during continuous trading session (day and after-hours trading session)

What cancellation methods are available?Currently under HKATS Username-based SMP, there is only one SMP cancellation method, i.e. cancel aggressive (“CA”). No additional cancellation method will be introduced to HKATS Username-based SMP after the enhancements.

Illustration refers as follows:

For ID-based SMP, there will be two types of cancellation methods, i.e. cancel aggressive (“CA”) and cancel passive (“CP”) are available to allow market participants (i.e. EP and/or their clients) to choose how orders are handled in the event of a self-match. Upon a potential match between two orders bearing the same SMP ID with a designated cancellation method:

a) the incoming order will be cancelled if CA is chosen; or

b) the resting order will be cancelled if CP is chosen.

Illustration refers as follows:

![]()

What is SMP ID?In ID-based SMP, SMP ID is a unique identifier allocated by the Exchange for market participants (i.e. EP and/or their clients) to tag in their orders for using the SMP model. Each SMP ID must be specified with either one of the cancellation methods during SMP ID application. The cancellation method is allowed to be changed upon request from market participants of EPs and the Exchange’s approval.

Who can apply for SMP ID?EPs can apply for the use of an SMP ID for its proprietary orders and/or for its clients. For the purpose of the SMP Service, clients shall only include direct client(s) of an EP, and where such client is itself an intermediary, the direct client of such intermediary client.

(Please refer to the Explanatory Notes for more details)

How many SMP IDs can an EP apply for itself and for its clients?SMP ID application for EP itself or its client other than asset management company/fund

Generally, only one SMP ID may be applied for use by an EP for its proprietary orders and only one SMP ID may be applied for each client of an EP, except when there are other independently operated trading unit(s) within the EP or the client for which additional SMP ID(s) may be applied.

SMP ID application for asset management company/fund

In the case of a client which is an asset management company, (i.e. maintains an account with the Primary EP in the name of asset management company), if there is only one SMP ID applied for and approved, the SMP ID can be used for different funds or accounts* managed by the same asset management company.

Alternatively, separate SMP IDs may be applied for use for different funds or accounts* managed or controlled by fund managers or trading decision makers whose operations are independent from one another. Each fund manager or trading decision maker can use such SMP ID for its managed or controlled funds or accounts*.

*Refer to accounts of which trading decision is controlled by the asset management company, e.g. discretionary accounts.

(Please refer to the Explanatory Notes for more details)

Can different entities co-use the same SMP ID?EP itself or its client other than asset management company/fund

An SMP ID may be applied for use by an EP for itself or for a client, as the case may be, together with any associates. Associates of a company means any of its holding companies, subsidiaries, or fellow subsidiaries, or any associated companies of them. Please refer to section 2, 13 and 15 of the Companies Ordinance for the meaning of associated companies, holding companies and subsidiaries respectively.

EP’s client which is an asset management company/fund

In the case of a client which is a fund, i.e. maintain an account with Primary EP in the name of a fund, an SMP ID may be applied for use by the fund, together with other funds or accounts* managed or controlled by the same fund manager or trading decision maker.

*Refer to accounts of which trading decision is controlled by the asset management company, e.g. discretionary accounts.

(Please refer to the Explanatory Notes for more details)

Are supporting documents required upon application of an SMP ID?Applicants will not be expected to provide supporting documents when submitting their new SMP ID application. Following an initial assessment, however, the Exchange may request for supplementary information or documentation such as organization structure, control measures relating to the use of the SMP Service and/or evidence to illustrate independence, depending on the individual circumstances of each application.

On an ongoing basis, the Exchange may also request such documentary evidence when it deems necessary for the purpose of monitoring the proper usage of the SMP Service.

What should EPs be aware of and remind their clients when using the SMP Service?The SMP Service is an optional service.

EPs and its clients should assess their needs and tailor their use of the SMP Service as per their business models, trading strategies and any other considerations as appropriate. They shall comply with the Rules of the relevant Exchange (i.e. SEHK and HKFE), the SMP requirements prescribed by the Exchange from time to time, and the terms and conditions stipulated in respective SMP forms and take steps to prevent and detect improper trading activities, including spoofing, unusual trading practice or non-compliance with any relevant Rules and Regulations. Order cancellations via the use of the SMP Service will be treated as activities initiated by the relevant EP and/or its clients and the use of the SMP Service cannot be used as a defence of any market misconduct / manipulative behaviour.

In addition, EPs and its clients should note that the approval of the use of SMP ID(s) does not constitute any endorsement of the Exchange on the trading activities related to the orders tagged with the respective SMP ID(s).

In particular, Exchange’s approval of SMP IDs do not constitute any endorsement on trades executed amongst orders tagged with different SMP IDs. Same as today, EPs and its clients have to assess themselves as to whether their trades are in compliance with the Rules of the Exchange or any laws or regulations including the Securities and Futures Ordinance and the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission.

Will the usage of the SMP Service be monitored?Yes, the usage of the SMP Service will be monitored. Usage of the SMP Service for any non-bona fide purpose may constitute a non-compliance of the terms of the SMP Service and may violate the Exchange Rules. EPs should remind their clients of the same.

EPs should take steps to prevent and detect improper trading activities, including spoofing, and report to the Exchange when unusual trading practices are identified.

What is the possible consequence of misusing the SMP Service or breaching the SMP requirements? The Exchange has the sole discretion in suspending, restricting, or terminating the use of a SMP ID or the SMP Service at any time, by notice in writing to the EP, if there is reasonable cause to suspect or believe that any of the prescribed requirements related to SMP are not properly followed or the SMP ID has been used or involved in any market misconduct or manipulative behaviour, where parties involved in any market misconduct and manipulative behaviour may be subject to legal or regulatory consequences.

What trading behaviour would be regarded as a misuse of SMP?Any usage of the SMP Service for improper, unethical, manipulative or non-bona fide purpose, including but not limited to spoofing and/or using the tagging of an SMP ID in an order as a cancellation instruction with an aim to cancel the relevant existing order(s), will be regarded as a misuse of SMP.

What are the expected control measures for using the SMP Service?EPs are required to, both initially and on a continuous basis, put in place and/or procure its direct client which is an intermediary to put in place relevant control measures to ensure the proper use of the SMP ID and detect any misuse of the SMP Service, including but not limited to measures to:

- ensure the information provided in each application of EP or its clients is accurate and fulfils the requirements prescribed by the Exchange from time to time;

- ensure an SMP ID is only used as stated in the respective SMP forms provided to the Exchange;

- ensure the use of the SMP Service is in compliance with the SMP requirements as prescribed by the Exchange;

- detect misuse of the SMP Service or market misconduct, e.g. spoofing.

EPs should report to the Exchange by email to msm_smp@hkex.com.hk when it detects any potential misuse of SMP ID.

Disabling ID-based SMP Function for Individual Order or QuoteFor orders and quotes with SMP ID specified: (i) as blank or (ii) with the first character as NULL (\0) or (iii) with the first character as SPACE, they would be treated as NOT using SMP token function by the system and, therefore, are not subject to SMP ID validation.

What is the applicable period for SMP?Both SMP models (i.e. HKATS Username-based SMP and ID-based SMP) are applicable in continuous trading session including day trading session and after-hours trading session. SMP is not available in pre-market opening period.

Does SMP apply to all order types?Upon enhancements, all order types (with the exception of combo/bait order against outright) during continuous trading session (day and after-hours trading session) are subject to SMP in both SMP models (i,e, HKATS Username-based SMP and ID-based SMP).