Overview

OTC Clearing Hong Kong Limited (OTC Clear) client clearing services provides market participants, who may choose not to become direct clearing members of OTC Clear, with access to central clearing by establishing a ‘client clearing’ relationship with an existing clearing member of the service.

The term ‘client’ typically refers to the customers of banks or broker dealers who operate in the capital markets. There is a wide range of client ‘segments’ amongst the end-users of OTC derivatives including asset managers, pension funds, insurance companies, hedge funds and corporates. In the context of central clearing the term may also be used to refer to smaller banks which, for reasons of cost or convenience, may not want to establish a direct clearing relationship with OTC Clear.

Clients may choose to use OTC Clear’s client clearing services for a variety of reasons including:

- To fulfil mandatory central clearing obligations for OTC derivatives which may be imposed on market participants and/or their trading counterparts by the Hong Kong regulators or by regulatory authorities in other global OTC derivative markets.

- To achieve certain economic benefits that may accrue from the central clearing of OTC derivative transactions via a Qualifying Central Counterparty (QCCP) including regulatory capital benefits, reduced Initial Margin requirements (relative to bilateral Initial Margin requirements under the Basel Committee on Banking Supervision's non-cleared margin rules) and to gain access to better transaction pricing as Central Counterparty (CCP) transactions are exempt from credit valuation adjustments (CVA).

- To benefit from the credit risk protection that central clearing can provide within a robust framework which segregates client assets from those of their clearing member and provides protections to those client assets and collateral in the event of the bankruptcy of their appointed clearing member.

Legal Framework

![]()

![]()

The overarching OTC derivatives regulatory regime in Hong Kong is covered under the Securities and Futures (Amendment) Ordinance 2014 which provides a framework for centrally clearing through a designated CCP.

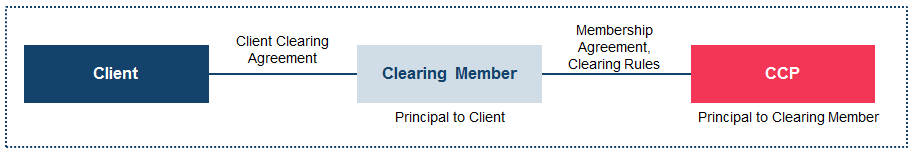

OTC Clear client clearing services operates a ‘principal-to-principal’ model.

- The model is built on two separate legal relationships: a transaction between the clearing member and the CCP and a transaction between the clearing member and the client.

- The client faces the clearing member as principal and in turn the clearing member faces the CCP as principal, via back to back trades between the parties.

- There is no direct contractual relationship between the client and the CCP.

- The legal protection of client assets is achieved by the establishment of a Security Assignment Deed between the parties which creates a ‘bridge’ between the contractual relationships.

Client Asset Protection Models

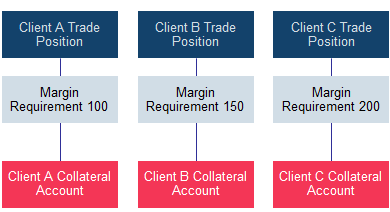

OTC Clear provides clients with different types of segregated accounts for the registration of Contracts and Collateral when onboarding to a clearing member. A clearing member that offers Client Clearing Services to one or more clients shall offer its clients the choice between the Client Clearing Category 1 Account Basis or a Client Clearing Category 2 Account Basis, or any other basis as OTC Clear may decide to introduce from time to time.

An individual segregated account would typically be expected to offer greater protection to the underlying client as their collateral will be ring-fenced and separated from that of other clients of their clearing member. This should allow greater ease in transferring a position to an alternative clearing member in the event of a default of the bankruptcy of their primary clearing member.

1a. Individual Segregation (Client Clearing Category 1 Account)

1b. Individual Segregation (Sponsored Settlement Membership)

To accommodate the increasing clearing needs of Cross Currency Swaps (CCS) and Deliverable FX Derivatives Contracts (DFX) in the market, OTC Clear will extend its client clearing model with the introduction of: Sponsored Settlement Membership (SSM). The SSM model is designed exclusively for Authorised Institutions (AIs) registered under the Hong Kong Monetary Authority (HKMA). As a Clearing Category 1 Client of a sponsoring Clearing Member (CM), a Sponsored Settlement Member will enjoy separate Notional Exchange Risk Limits from their sponsoring (CM) in order to manage their settlement exposures with higher flexibility.

Eligibility

Sponsored Settlement Membership will be exclusively open to HKMA AIs under a Hong Kong incorporated Clearing Member, fulfilling the following criteria:

- Admission assessments

- Operational and system capabilities for OTC derivatives settlement

Settlements

A Sponsored Settlement Member shall settle its daily cash flow obligations of Variation Margin, Price Alignment Interest, coupon and notional exchange settlement directly with OTC Clear. The sponsoring CM is responsible for handling the Initial Margin obligation and default fund contribution for its House together with their Client (including the Sponsored Settlement Member) Position Account(s).

2. Omnibus Net Segregation (Client Clearing Category 2 Account)