Hong Kong Securities Clearing Company Limited (HKSCC), as a Central Counterparty (CCP), provides clearing services to transactions in securities that are accepted as eligible by HKSCC (Eligible Securities) via the Central Clearing and Settlement System (CCASS). CCASS determines the stock and money obligations of Participants to a securities transaction so that Participants could effect delivery or receipt of securities and make payment or receipt of money on the settlement day. Currently, HKSCC acts as the CCP for the following securities transactions settled under the continuous net settlement (CNS) system:

- Exchange Trades: trades reported to or effected on The Stock Exchange of Hong Kong Limited (SEHK) (excluding trades isolated for settlement under the isolated trades system by the clearing participants at the time of the transaction or by HKSCC for risk management purposes);

- China Connect Securities Trades: trades in China Connect Securities executed on China Connect Markets via Shanghai Connect or Shenzhen Connect; and

- Clearing Agency Transactions: exercised option trades transmitted from The SEHK Options Clearing House Limited (SEOCH) to CCASS for clearing and settlement of the underlying securities of stock option contracts.

Key Features of the CNS System of CCASS▼

- Novation – HKSCC assumes the role of seller to the buying Participant and buyer to the selling Participant. Upon novation, HKSCC assumes counterparty risks associated with the novated contracts to its Participants, which are also known as Market Contracts; and

- Daily netting – the stock positions of a Participant under the Market Contracts on the same day, in the same Eligible Security, are offset against each other to result in one net long or net short stock position with HKSCC in each Eligible Security on each business day. Any outstanding unsettled net stock positions of a Participant at the end of a settlement day are carried forward to the next settlement day and continuously netted against any opposite stock positions due for settlement in the same security.

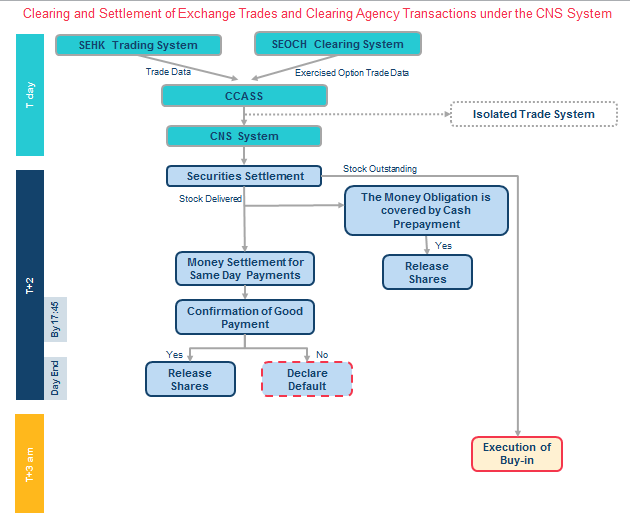

-Clearing and Settlement of Exchange Trades and Clearing Agency Transactions under the CNS System ▼

Both Exchange Trades and Clearing Agency Transactions are cleared and settled on two days after the trade day (i.e. on a T+2 basis). The stock positions from the Exchange Trades and Clearing Agency Transactions are netted and settled together. Details of these securities transaction are electronically and automatically transmitted to CCASS by SEHK and SEOCH on each trading (T) day. Participants receive Provisional Clearing Statements of their stock and money positions through their CCASS terminals shortly after 17:00 (including details of Exchange Trades only) and 20:00 hours (including details of Exchange Trades and Clearing Agency Transactions) on each T day for reconciliation. Final Clearing Statements are available to Participants shortly after 14:00 hours on T+1 day for confirmation purposes.

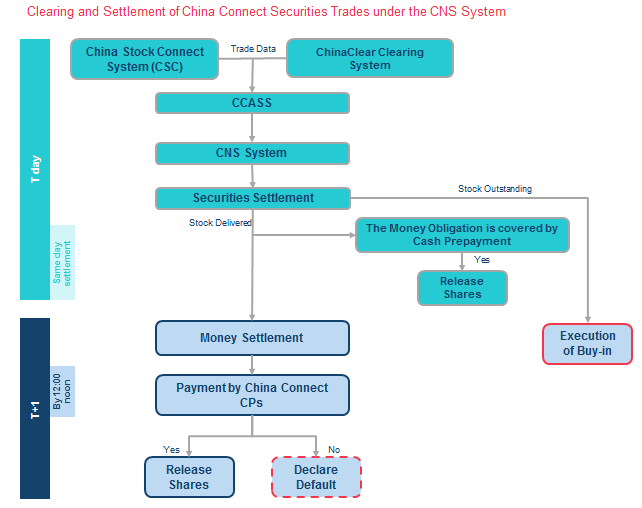

-Clearing and Settlement of China Connect Securities Trades under the CNS System ▼

China Connect Securities Trades follow the settlement cycle of the Mainland stock market, where stock is settled on T-day and money is settled on T+1 day. SEHK transmits details of China Connect Securities Trades directly from its order routing system, China Stock Connect System (CSC) to CCASS in real-time. HKSCC reconciles the provisional clearing data files retrieved from ChinaClear’s system against the trade records from SEHK. Final Clearing Statements are available to related Participants shortly after 16:00 hours on T day.